37+ Calculate which loan to pay off first

The first factor you want to consider when paying off your loan is the interest rate. Ad Compare Best Emergency Loans with Lowest APR.

35 Profit And Loss Statement Templates Free Business Templates

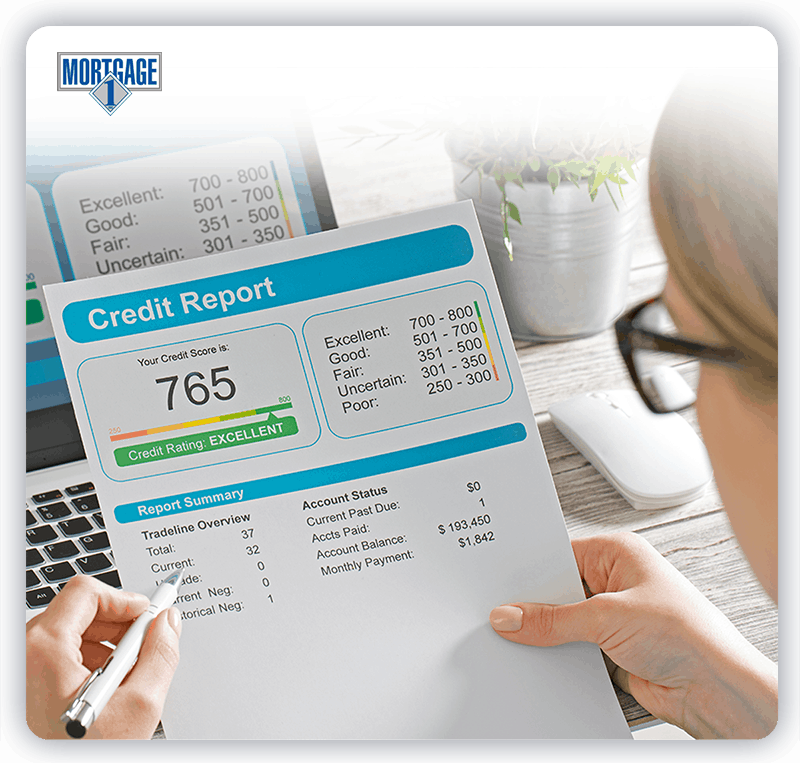

For example the average credit cards interest rate was 1471 in 2020.

. The Credit Cards Payoff Calculator uses a method known as the Debt Avalanche method The calculator also. 51 ARM IO 71 ARM. Repay the smallest loan.

Highest interest rate first Mathematically youll usually pay off your debt more quickly and with less interest if you go this route. The loan is for 15 years. You can also opt for a.

The calculator below estimates the amount of time required to pay back one or more debts. Well walk you through some steps to consider when paying off debt including calculating your total debt owed and figuring out interest rates for each loan to help you. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Additionally it gives users the most cost-efficient payoff sequence with the option of adding. Your monthly payment would be 29588 meaning that your total interest comes to 1325840. This will usually be unsecured loans such as credit cards payday loans and merchant cash.

PVdfracPMTileft1-dfrac11inright Example. A higher interest rate means. Youll pay off the smallest student loan first rather than the one with the highest interest rate.

Credit cards and personal loans tend to have higher interest rates. Quick Approval Trusted Lenders. Paying off a 10000 loan at 453 interest in five years rather than the standard 10-year repayment timeline will save you about 1259 in interest.

How do I calculate which loan to pay off first. 30 year fixed refi. Below are two of the most popular methods for paying off debt.

There are multiple ways to approach paying off credit card debts each month. Use this loan calculator to determine your monthly payment interest rate number of months or principal amount on a loan. National Debt Relief is Our Highest Rated Debt Consolidatoin Loan Company on All Criteria.

Ignoring interest rates can be a big mistake when paying off debt. Ad Free Independent Reviews Ratings. When deciding which student loan to pay off first take note of whether your loans have fixed or variable rates in addition to the rate itself.

If that sounds like you use the debt snowball method. To calculate the loan amount we use the loan equation formula in original form. For example say your minimum payment for that student loan is about 32 a month over 10 years.

Obviously the higher interest rate loans should be paid off first. If you dont want to lose more money than necessary pay off your high-interest loans first. If you made enough extra payments to pay that same loan off in seven years youd only pay 2247 in interest a savings of 1026.

In comparison the average auto. Paying off a loan with a 453 interest rate for. If you budget your money carefully and youre able to add 250 to that payment.

Pay High-Interest Loans Off First. Heres an example. Your bank offers a loan at an.

15 year fixed refi. However dont just look. You borrow 40000 with an interest rate of 4.

Get a Savings Estimate.

10 Steps Toward Home Ownership Mortgage 1 Inc

Free 10 Common Core Spending Plan Samples In Pdf Ms Word

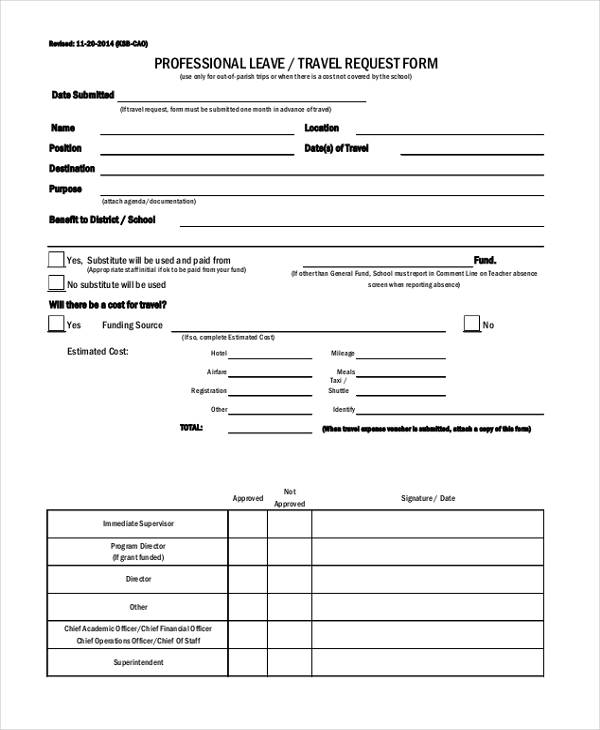

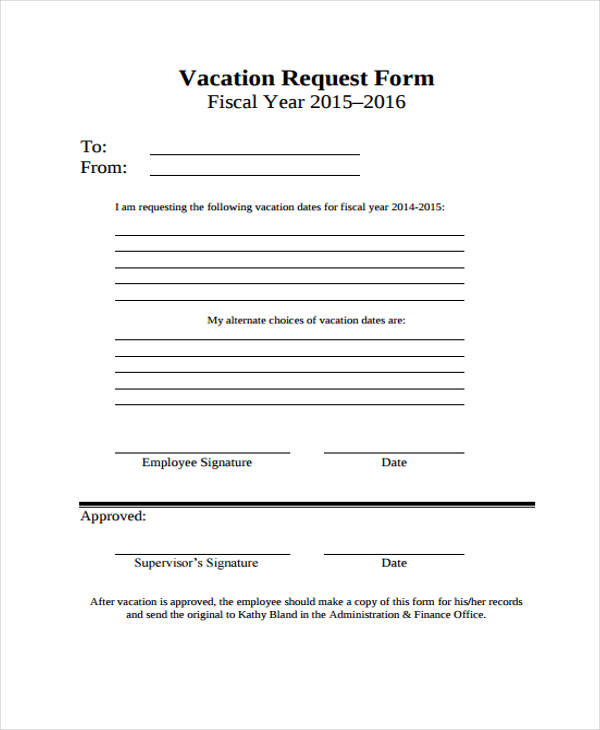

Free 37 Travel Request Form Examples In Pdf Ms Word Excel

Music Concert Ticket Psd Template Free Music Concert Concert Tickets Concert Ticket Template

Free 37 Sample Request Forms In Pdf Excel Ms Word

Real Estate Company Chennai South India Sameera Groups

Tables To Calculate Loan Amortization Schedule Free Business Templates

30 Free Profit Sharing Agreements Free Business Legal Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

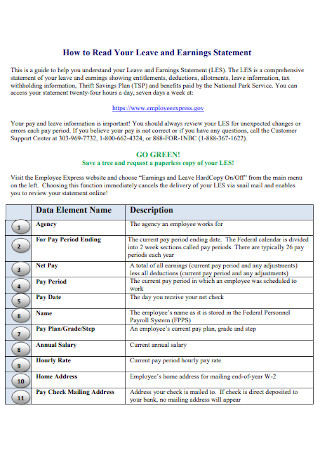

37 Sample Earnings Statement Templates In Pdf Ms Word

37 Sample Earnings Statement Templates In Pdf Ms Word

Free 37 Event Forms In Pdf Excel Ms Word

35 Profit And Loss Statement Templates Free Business Templates

Free 37 Sample Request Forms In Pdf Excel Ms Word

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property B Real Estate Houses Property Buyers Sell House Fast

Types Of Fintech Companies Ein Des Ein Blog

37 Key Rv Industry Statistics Trends Facts 2022 Data